What’s in the Spring Budget for Small Business?

The Chancellor, Rishi Sunak, has today unveiled the Spring Budget for 2021. The key financial statement comes as retail and hospitality businesses prepare to gradually reopen over the coming months, ahead of a full return to normality expected later this summer.

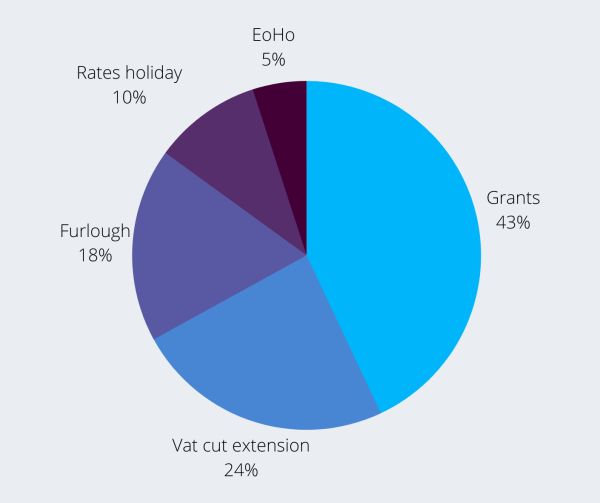

The budget outlined a series of proposals, each designed to support small businesses. Read on for our breakdown of the £65bn package, as well as our analysis on what means for small business.

Introduction of restart grants and loans

The Treasury is set to introduce “restart” grants and loans which are intended to replace the bounce back loans that expire at the end of this month. Since non-essential retailers will open first, they will be eligible for grants worth up to £6,000. Hospitality and leisure businesses, which are not set to fully reopen until later this spring, will receive far more generous grants, stretching to as much as £18,000.

When revealing the new grants scheme, Sunak said: “Non-essential retail businesses will open first, so they’ll receive grants of up to £6,000 per premises. Hospitality and leisure businesses, including personal care and gyms, will open later, or be more impacted by restrictions when they do, so we’ll give them grants of up to £18,000.

The introduction of restart grants is likely to be warmly welcomed by retail and hospitality businesses. In our recent survey of business owners, almost half said that the introduction of additional grants ought to be the Chancellor’s top priority.

Business rates holiday extended

The Chancellor also announced that the business rates holiday will continue until the end of June for the hardest-hit retail, hospitality and leisure businesses. For the rest of the year, this will switch to a two-thirds discount, up to a value of £2 million for closed businesses, with a lower cap for those who have been able to stay open. In the Chancellor’s words, this represents a “£6bn tax cut for businesses”.

In short, this means that eligible retail, hospitality and leisure businesses pay no business rates for 3 months, with up to 66% relief for the rest of the year.

Furlough scheme extended to September

The Coronavirus Job Retention Scheme, or furlough, will be extended through to September. Until the end of July, there will be no changes to the existing scheme, meaning that government will continue to pay 80% of wages, up to a value of £2,500 per month. However, from the end of July, employers will be expected to contribute 10% towards the hours their staff do not work in July. This will then increase to 20% in August and September.

VAT cut extended

The Chancellor also announced that the current temporary 5% rate of VAT on food and soft drinks, hotel accommodation and leisure attractions will be extended until September 30. However, in a further boost to small businesses, the Treasury will implement an interim rate of 12.5% for another six months, meaning VAT will not return to pre-pandemic levels until April 2022.

For advice and guidance on how to reopen your business safely and effectively, visit our COVID-19 Business Support resource hub.