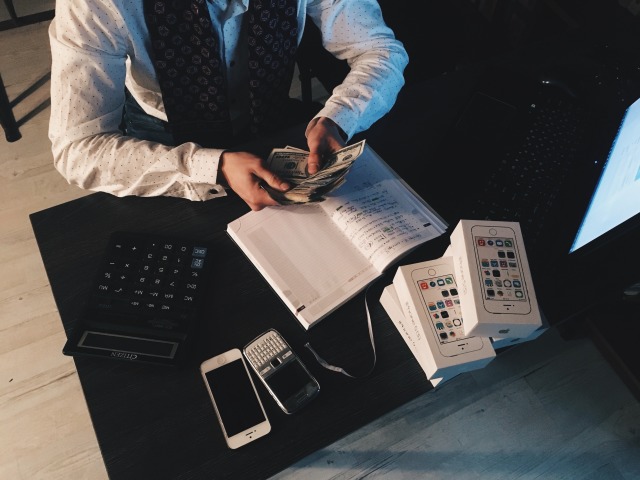

Cash Handling Procedures in Retail

Over the course of a busy working day, there’s a lot to take care of. When the stock has been delivered and shelved, trade has stopped and you’re ready to put your feet up, hunting for missing cash will be the last thing you want to do.

This kind of end of day scramble for missing cash will be familiar to most retailers, which is why ensuring best practices for cash handling are worth the effort. Doing so will save time and money, setting your retail business up for success.

Cash handling procedure: retail template

The BFS (Business and Financial Services) suggests five key areas for cash handling management[1]:

- Stewardship: Retail managers are the stewards of business and must take responsibility, both during smooth and difficult days of trading.

- Accountability: Each person that handles cash has been given a duty of care, and must follow procedures, maintain security and act with discretion.

- Separation of duties: Having different members of the team be accountable for different tasks relating to cash management adds transparency to procedures without compromising security.

- Physical security: Keep cash out of sight wherever and whenever possible. Cash counting should be done in secure areas and away from the public, and safe combinations and access codes should be complex and unknown to all not directly using them.

- Reconciliation: Confirming amounts of cash counted and transferred and documenting this process will show any discrepancies quickly and will narrow the window of possibility in which cash may have gone missing.

Planning your cash handling procedures around these five strong principles will ensure maximum efficiency and security when looking after physical money.

Accountability and stewardship

Accountability and stewardship is a key part of cash handling. One of the big fears in business is concealment and theft. Discovering a trusted member of staff or a customer has taken hard-earned money for themselves is disheartening, demoralising, and can make running a business much more difficult as focus shifts from improving trade to security.

However, an effective cash handling process will not only create a clear paper trail and make theft easier to discover, but it will also make such acts more difficult to commit, reduce the temptation, and make honest errors rarer and more obvious.

The first and most obvious trick to managing cash is using cash management technology during transactions. EPOS (electronic point of sale, sometimes just called POS) has this built into its software. This means that when a sale is made, it is automatically recorded as either cash, card or any other accepted form of currency. It also records who completed the transaction. The cashier can immediately deposit this in a secure cash drawer and provide the customer with any necessary change.

Physical security

Physical security isn’t just about investing in smart safes or cash recyclers. The most important part is establishing when and where cash can be moved or handled. Outside of the transaction process, it’s important to determine when Z reads will be performed and where that process should take place.

Ideally, cash can be taken to a private office where management can be completed by those entrusted to handle the money. When cashing up by an EPOS terminal, it’s better if the business is closed so the process is not seen by the public.

However, it is still good practice never to keep larger sums of money in the cash drawer when avoidable. On busy days, performing multiple Z reads and transferring cash securely to the safe is advisable.

Cash handling procedures in retail stores: controlling access

A further procedure that it pays to fine-tune is around contact with the business's cash. Who, how, and when should an employee be in contact with any amount of cash? This also means considering whether certain managers should have the combination to the safe.

Once more, your EPOS can help with this. Staff privileges is one of the factors that an assigned staff role can control electronically. New staff might only be able to open the cash drawer during transactions and so cannot access even the days while alone. Team leaders, with a little more trust, might be able to perform “no sale” actions, but this is recorded under their name and can be done to correct minor issues.

The question of who performs Z reads is also controlled through your EPOS. For instance, Epos Now staff roles allow a blind EOD where cash figures can be counted and inputted without seeing an expected figure, which a mid-level employee can do.

These kinds of controls minimize the number of people handling cash and the amount of cash they handle, which reduces risk and helps deter theft.

How to handle cash in retail

Any contemporary cash handling procedure can assume the business's EPOS will have an integrated credit card machine. This is relevant because with an integrated device, no card payments can be put under an incorrect tender, reducing the need for risk.

But training staff to follow the correct procedures is key to ensuring that any policies you create have the desired effect. Discussing cash handling procedures with new employees and having a dedicated section in any staff handbooks or documents ensures employees have no excuse not to be following them.

Many cashiers, particularly those who have previously worked without EPOS, will habitually use mental arithmetic to calculate the change required. This is the first habit to break as an EPOS system will automatically and reliably calculate change without errors.

This will also encourage accurate data input during transactions which helps create a clearer digital trail of cash flowing through the business. This helps in the event of a refund or dispute with a customer, as transaction records will accurately reflect what transpired.

It also means that the end of day (EOD) process will be smoother, as all expected tender types should match the money in the cash drawer. For instance, if a cashier incorrectly processes a card transaction as cash, when a manager closes the till, the expected cash figure will show a discrepancy, and a hunt for the cash will ensue.

This does not always happen, as the total figure (of all tender types) may still be accurate, and this is what managers look for. However, good cash handling procedures reduce these occurrences.

Business management made easier

An Epos Now retail solution provides businesses with software and hardware that helps a business reach the next level. With regularly updated technology, Epos Now is dedicated to pushing the boundaries of EPOS capabilities, integrating with card processing, online stores, accounting software and more.

Epos Now customers can:

- Streamline service with quicker transaction processing and modifiable till settings

- Control and monitor trade using cloud technology and real-time, detailed reporting

- Run their businesses smoothly through easy inventory management and flexible product update capabilities

- Create a bespoke business setup through hundreds of optional apps perfect for retail users

To find out more about what Epos Now can do for your business, submit your information below or get in touch with our expert team direct.

Join Epos Now for modifiable software and flexible hardware to suit your industry

trusted by over 40,000 businesses worldwide