What Is STP? A Clear Guide to Straight Through Processing

Last year, over half of US businesses (53% to be exact) were hit by at least six fraud cases. 41% of those had seven or more instances.

Now, imagine if you could cut down on that risk and get rid of all the manual steps slowing things down.

That’s where straight-through processing (or STP for short) comes in, automation that keeps your transactions moving faster and more securely.

Today, we’re going to walk you through exactly what STP is, how STP works, why businesses swear by it, where the challenges pop up, and the smartest ways to actually put it into action.

What does STP mean

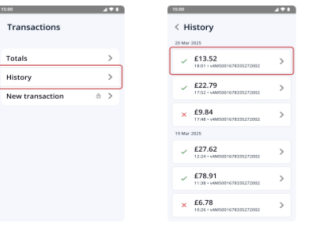

Straight-through processing (STP) is when payments move from start to finish automatically without any paperwork, manual steps, or anyone typing things in behind the scenes. It’s all done electronically.

A brief history

It all started with systems like ACH and SWIFT, which laid the groundwork for these kinds of electronic payments and transfers. Over time, those early networks evolved into the fast, modern systems we rely on today.

How we got here

Not too long ago, traditional payment processing was all about paper. Things like checks in the mail, forms to sign, stacks of documents to process. It was messy, full of opportunities for mistakes. Businesses had to wait days (sometimes weeks) for payments to clear.

Then came the push for speed and security. Technology stepped in, making it an automated process, and electronic transactions started replacing paper. Instead of mailing a check, payments could move digitally in real time. That shift from paper trails to digital rails is what set the stage for straight-through processing as we know it today.

How STP payments work

If you’ve ever wondered “what is STP?” in payment processing service terms, it’s basically an automated process that handles financial transactions from start to finish without anyone stepping in. This section is all about understanding straight through processing (STP):

The end-to-end process

Here’s the flow:

- Initiation: A payment transaction kicks off electronically, maybe through online banking, accounts receivable systems, accounts payable tools, or other electronic systems.

- Validation: The STP system instantly checks the payment information and transaction details like account numbers, payment instructions, amounts, to make sure the data is accurate.

- Add info: If extra details are needed (like exchange rates, security details, or other sensitive data), the system enriches the transaction automatically.

- Risk scan: Built-in STP processes scan for fraud, errors, or regulatory compliance issues, something the traditional method often struggled with.

- Approve: If everything looks good, the system greenlights the transaction.

- Send: The payment system then sends the electronic transfers to the right place like a clearing house, a payment processor, or an exchange.

- Settle: Funds move electronically, accounts update, and cash flow is adjusted in real time.

- Confirm: Finally, both sides get a confirmation that everything went through.

The tech behind STP

Electronic processing works via these two technologies:

1) SWIFT: Think of it as the global messaging network that financial institutions use to send payment information securely. If banks around the world need to move money, chances are they’re using SWIFT.

2) EDI (Electronic Data Interchange): This one’s more about businesses trading info like invoices, accounts receivable, accounts payable, and other payment instructions. Basically, it’s how companies swap sensitive data without drowning in paperwork.

Put it all together and you’ve got the tech that makes payment processing STP work. Without these systems, we’d still be stuck in the world of traditional payment methods and paper-based processes (aka the dark ages of payment processing).

Real-world examples

If you’re in a highly regulated industry, deal with high transaction volumes every day, or handle sensitive personal data, STP can make life a lot easier.

Here are just a few industries that really benefit:

- Banks and financial institutions: Use it for payment processing, trade settlements, account reconciliation, and protecting financial data.

- Insurance companies: Makes claims, policy setup, and premium collection faster and smoother.

- Ecommerce platforms: Handles quick, secure online payments and order fulfilment.

- Healthcare providers: Simplifies patient registration, billing, and insurance claims, while protecting health records.

The benefits of STP for businesses and banks

Straight-through processing (STP) brings a bunch of wins for businesses and banks alike:

Faster, more accurate payments

Imagine sending a payment and it just… happens. No delays, no errors, no awkward “oops, wrong account” moments. That’s what STP does. It automates everything so payments are fast and accurate.

Smoother cash flow

If you’ve ever been stuck guessing when money’s coming in or going out, you know the pain. STP gives you a clear view in real time. You can see exactly where every payment is, which means fewer surprises and no more last-minute scrambling. It takes the stress out of managing cash.

Efficiency gains

STP cuts out repetitive tasks, meaning your team can focus on actual work instead of admin and busywork. The best part about this is that automation saves money. Fewer mistakes, less manual labor, minimal paper use: all of that adds up to lower operational costs.

Security and compliance

Finally, let’s talk safety. STP isn’t just fast, it’s smart. Automated checks for accurate data, fraud detection, data validation, and audit trails help protect sensitive data and keep you on the right side of regulations.

Common challenges when moving to STP

It's not all perks, though. Here are some key considerations when completing transactions via STP solutions.

Outdated systems

If your current setup is stuck in the past with legacy tech and manual workflows, things can get messy. Old systems weren’t built for automation, so integrating them with STP can feel like trying to fit a square peg in a round hole.

With this in mind, some solutions include:

- Phased implementation: Don't just replace your tech right away; do it gradually. Slowly make sure that all of your legacy systems become STP-compatible.

- Middleware: This kind of software is great to bridge the gap between your newer systems, those STP-compatable products, and your legacy systems.

- API integration: APIs help to connect your legacy systems with your STP platforms.

Data roadblocks

STP only works if your transaction details are clean and consistent. Messy data (which we call bad data quality), missing info, or non-standard formats can throw a wrench in the process. Without proper validation, even automated systems can hit snags, slowing down payments.

To combat this, focus on:

- Data cleansing: Clean and standardize your past data so that it's compatible with STP processes.

- Data governance: Put governance policies and procedures in place to maintain data quality.

Resistance to change

Some teams don't like things to change too much. After all, who wants to learn a whole new system or worry about implementation costs? Rolling out STP takes planning, training, and buy-in across the organization. Without that, even the best technology can struggle to gain traction.

A great way to manage this resistance is to offer incentives and really focus on good employee recognition to those who fully embrace and champion and thrive in STP adoption. Sometimes people just want to hear that they're doing a good job and are appreciated.

Global and regulatory complexities

Different countries, emerging economies, and varying regulations can complicate electronic exchanges. Compliance rules aren’t always the same, and adapting your STP processes to meet them isn't always easy.

Some solutions include:

- Compliance knowledge: Get in touch with compliance experts (or hire a legal team) so that you know you're complying with regulations.

- Audit trails: Have strong audit trails to document all STP activities.

- Security measures: Make sure you have really strong security controls in place to protect payment data.

System limitations

Internal systems might work great within your company, but struggle with external partners. Interoperability issues, where systems just don’t integrate well with each other, can slow down adoption and reduce the efficiency gains you’re hoping for.

One way to fix it is to choose STP solutions that are designed to integrate easily. Look for systems that support common standards like SWIFT, EDI, or API connections.

Payment processing services made simple

Take integrated payments at one fixed rate, with no hidden fees - anywhere, any time.

Implementing STP

Here are some tips to help you fully implement STP:

Core components

A strong STP system isn’t just one thing. No, it’s a mix of tech and processes. You need

- Electronic data exchanges

- Automated validation

- Risk checks

- Seamless routing.

Put them all together, and you’ve got a system that can handle payments, trades, and other financial transactions almost entirely on autopilot.

Best practices

To get the most out of STP, follow some best practices:

- Integration: Make sure the STP system works with your existing accounting or ERP software.

- Workflow optimization: Organize the process so transactions move smoothly from start to finish.

- Analytics and monitoring: Track your transactions, spot problems early, and make improvements.

Basically, don’t just install the system, set it up to fit your business and keep an eye on it.

Exception handling

Even smart systems run into problems sometimes. Exception handling is just a fancy way of saying: “Here’s what to do when something goes wrong.”

- If a payment has missing info or an incorrect account, the system flags it.

- You can fix it quickly before it slows down other transactions.

This keeps small mistakes from turning into big problems.

Where STP shines

STP works best in areas where there’s a lot of repetitive work. Things like:

- Accounts payable (AP)

- Accounts receivable (AR)

- Insurance

- Payroll

- Trade settlement

Anywhere you need to move money or process transactions a lot, STP saves time and reduces mistakes.

Measuring success

You can tell STP is doing its job by checking:

- Automation rate: How many payments happen automatically? Higher is better.

- Scalability: Can it handle more payments as your business grows?

- Performance: How fast are transactions, and are there fewer mistakes?

Choosing the right vendor

Finally, picking the right partner is huge. Your STP vendor should play nice with your ERP, support e-remittance, and offer flexible integrated payment solutions. Don’t just go for the flashiest system. Look for reliability, support, and a vendor who understands your workflow. The right choice makes implementation way smoother and ensures your STP system delivers on all its promises.

Why straight-through processing matters

Straight-through processing is a smart system that moves money and handles payments automatically.

We’ve seen the perks, things like faster payments, smoother cash flow, lower costs, more accurate data, happier customers, and safer transactions.

There are challenges to consider, like old systems, incorrect data, and getting everyone on board, but with the right setup and a good vendor, those can be handled.

STP is the backbone of modern, automated payment processing. It keeps money moving, businesses running, and mistakes to a minimum.

Liked this guide? Check out some more handy payment resources to keep leveling up your knowledge:

FAQs

- What is STP and what does it stand for?

-

STP stands for straight-through processing, and it’s a system that moves payments automatically from start to finish.

- How does straight-through processing compare to traditional payment methods?

-

Unlike old-school paper or manual methods, STP is way faster + more accurate. It’s a great way to make payments painless.

- What are the key benefits of STP for accounts payable and receivable?

-

It speeds up payments, reduces mistakes, saves time, and keeps cash flow smooth.

- What best practices should businesses follow when adopting STP?

-

Connect it to your existing software, streamline workflows, streamline payments, keep an eye on performance, and plan for handling any errors.