Streamline Payments for Success: Best Practices to Simplify Your Payment Process

When payments are slow, confusing, or clunky, it affects the whole business. Customers get frustrated, staff waste time fixing mistakes, and money takes longer to reach your bank account.

60% of small businesses say cash flow is their biggest challenge.

That’s why making payments simpler and smoother is one of the smartest moves you can make for your business.

Today, we’ll walk you through exactly how to do that. But before we dive into the steps, let’s look at the key benefits you’ll gain and the common payment pain points many businesses face.

Whether we’re in retail, hospitality, or services, streamlining payments can make a big difference–so let's get into it.

Why does streamlining your payment processing matter?

Before we get into the how, we think it's really important that you understand the why.

- Why does payment processing affect cash flow so much?

- Why does it have such a big impact on customer experience?

- And why is it such a big deal if we’re planning to grow?

Let’s look at the four biggest benefits of getting this right:

1. It reduces manual errors and late payments

We're human–we're going to make mistakes sometimes. But when we're making mistakes with payment information (mistakes like keying in the wrong amount, forgetting to send an invoice, or not chasing up a late one), it's going to directly affect cash flow.

When we streamline things with automation, integrated systems, or just a simpler process, there’s less room for those little slip-ups. Invoices go out on time. Payments come in faster. And we don’t spend hours fixing what should’ve worked the first time.

2. It improves customer satisfaction with faster checkout

As a customer, the last thing you want is to get home from your coffee run, or wake up after a night at the bar to realise you've been double-charged. You also don't want calls from people being told your card didn't go through, and you need to go back.

When we make checkout quick and smooth, we avoid those issues for our customers. This means no long waits, no confusing receipts, no “Did that go through or not?” moments.

They leave happy, and that means they’re more likely to return.

3. It ensures better security and compliance

Payment processing security falls under a set of rules called PCI DSS - (that’s Payment Card Industry Data Security Standard for those who love acronyms). It’s a way to keep customer payment info safe and sound.

If you fail to comply, you could have to pay penalties of up to $100,000 a month and for a small company that's essentially bankrupt.

4. It makes your operations more efficient

Orderly businesses, the kind that work like clockwork, keep customers happy and staff less stressed.

When you streamline your global payments, operations will naturally work more smoothly. Instead of worrying about fixing the entire process, you can just focus on running your business.

Key areas to simplify in the payment process

Now that you know why simplifying payments matters, let’s move on to the where. Where exactly can you find the quick wins to make your payment process smoother and faster?

In this section, we’ll highlight the key areas where small changes can make a big difference.

1. Offer multiple payment methods

Think about how you pay when you shop or grab a coffee.

Most of us tap our cards or phones these days. Other used credit cards. Some use mobile wallets like Apple Pay or Google Pay, and contactless cards. But there are still a few people out there who are more partial to providing cash.

Offering multiple payment options isn’t just about being trendy. It’s about making it easy for your customers to pay in the way they prefer. The more options you give them, the less chance they’ll walk away frustrated or empty-handed.

It’s a simple win: more payment choices mean smoother checkouts, happier customers, and more sales.

If you want to learn what works best for retail, check out our guide on Retail Payment Processing, it’s packed with tips.

2. Automate invoicing and payment reminders

Chasing late payments is nobody’s favorite job. It’s time-consuming, stressful, and quite honestly a little awkward.

Luckily, we don’t have to do it ourselves anymore. With the right systems, ones that are automated invoicing and payment reminders happen without us doing a thing. The software sends the invoices on time, follows up with gentle reminders, and keeps track of payment status like who’s paid and who hasn’t.

This means that you don't have to go digging through emails or spreadsheets wondering where that payment is. It frees up time and keeps cash flowing regularly, without the drama.

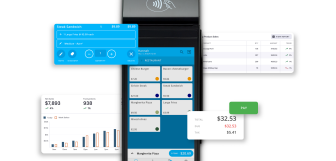

3. Integrate your POS system with payments

POS stands for ‘Point of Sale’ – which is the technology you use to complete a sale.

Think of the cash register, but smarter. It records sales, tracks inventory, and sometimes even manages customer data.

Integrating payments means connecting your POS system directly to your payment processing. Instead of manually entering payment details or juggling separate systems, everything happens together, in real time.

This means less chance for human error, like double entries or mismatched records. Your inventory updates instantly, your sales numbers match your payments, and your accounting becomes way simpler. That's the true benefit of integrated payment solutions.

When your POS system, cash register and payment system work as one, the whole sales process speeds up, cash flow improves, and you get a clearer picture of your business.

4. Use a user-friendly payment interface

We all know how frustrating it is when payment screens are confusing or they lag. That’s when customers abandon their carts or walk away without buying. It also holds up a queue, which isn't ideal.

A user-friendly payment interface means the process is simple, fast, and clear. Your team can easily understand the card machine, POS screen giving them a much better user friendly experience.

At the same time, your customers are quickly being served and not left huffing and puffing in a line of people or rolling their eyes because you've told them their payment didn't go through.

Better experiences all around - less cart abandonment, more loyalty, and a smoother day for everyone.

5. Streamline merchant services for global payments

Dollars, pounds, euros, rupees, yen.

If your business deals with customers or suppliers across borders, accepting multiple currencies can get complicated fast.

That’s why partnering with merchant service providers who handle these currencies seamlessly is key. It simplifies foreign currency acceptance, cuts down on extra fees, and speeds up payment processing.

So if you're going global and want up to date conversion rates, having the right merchant services in place makes expanding your business a whole lot easier.

Tools and technology to support streamlined payments

Here are the tools that make payments easier:

- POS systems: We mentioned these before. They’re the machines or software you use at checkout. They handle sales, track stock, and take payments all in one spot. When everything talks to each other, things happen faster and mistakes happen less.

- Automated invoicing tools: These send bills and payment reminders automatically. So, you don’t have to chase people down.

- Payment APIs: Think of these as the links that connect your website or app straight to payment services. This makes paying quick and smooth.

So, how payment processing work? When someone pays, their info is sent safely to their bank to check if they have money. If all’s good, the money moves from their account to yours, usually in seconds.

Security is super important. Using secure payment processing keeps both you and your customers safe. If you want to learn more about this, check out our guide on secure payment processing.

Payment processing services made simple

Take integrated payments at one fixed rate, with no hidden fees - anywhere, any time.

Industry-specific considerations for hospitality and retail

Different businesses have different payment needs. Let’s break down a few industries:

Restaurants

Speed matters when it comes to restaurant payment processing. Customers want quick, tip-friendly transactions. Your payment system also needs to:

- Handle split bills so groups can pay for their own share

- Accept different payment methods

- Work well with tableside or contactless payments to speed up checkout

- Make tipping easy

Hotels

With hotel payment processing, you need to make sure that your payments easily integrate with your property management system, as well as your POS system. Your payment system should:

- Link payments directly to reservations and guest accounts

- Support deposits, pre-authorizations, and final billing all in one place

- Handle multiple payment methods, including international currencies

- Provide clear, detailed invoices for guests

Retail

Own a small boutique or large supermarket chain? Your retail payment system should help you build customer loyalty and keep things simple for your team. Your payment system should:

- Support loyalty programs that reward repeat customers

- Send digital receipts to reduce paper and make returns easier

- Work seamlessly with a cash register for small business

- Accept multiple payment types, from cards to mobile wallets

Best practices for streamlining your payment system

When it comes to making your payment process smooth and simple, there are a few best practices that really pay off:

- Centralise systems: Use payment tools that work together in one place. This cuts down on juggling different platforms and reduces mistakes.

- Audit fees and eliminate hidden charges: Keep an eye on what you’re being charged. Some fees can sneak up on you, so regularly review your statements and talk to your provider about any surprises.

- Regularly update security protocols: Payment security isn’t a set-it-and-forget-it thing. Keep your software and systems updated to protect your business and customers from fraud.

- Stay informed on payment trends: Payment methods and tech change fast. Keeping up-to-date helps you offer what your customers want and stay competitive.

Choosing the right payment processing partner

That’s it from us. We’ve officially taught you everything you need to know about streamlining your payments.

When it comes to picking the right payment processing partner, here’s what to look for:

- Transparent fees: No surprises or hidden costs. You want to know exactly what you’re paying for.

- Easy integrations: Your payment system should work smoothly with your POS, invoicing, and other tools.

- Scalability: Choose a partner that can grow with your business, whether you’re expanding locations or adding new payment options.

Working with a reliable partner like Epos Now means access to flexible, secure, and easy-to-use payment processing solutions that fit your business needs.

If you want to learn more about how money moves in and out of your business, check out our blogs on Accounts Payable vs Accounts Receivable and Understanding Accounts Receivable Aging (AR Aging).

In short, the right partner helps you save time, reduce errors, improve customer satisfaction, and boost cash flow — all the good stuff that makes your business run better.

FAQs:

- How can I streamline my business’s payment processing system?

-

Use integrated, easy-to-use payment tools that handle multiple payment methods and automate routine tasks.

- What are the most common mistakes businesses make when handling customer payments?

-

Common mistakes include manual entry errors, slow payment processing, and unclear payment policies.

- Why is integrated payment processing better than standalone systems?

-

Integrated systems reduce errors and save time by connecting payments directly with your sales and accounting tools.

- How does a POS system help simplify transactions and improve cash flow?

-

A POS system speeds up checkout, tracks sales in real time, and ensures payments go straight into your accounts.

- What tools can help reduce late payments and automate payment reminders?

-

Automated invoicing software and payment reminder systems help keep payments on time without extra effort.